Phnom Penh, Sep 30 - Cambodia has been one of the most ideal locations for young family business leaders, impact investors, and entrepreneurs to visit and explore in Hong Kong, with its fascinating heritage, legacy architectures, and rich culture and history. As early as 2017, Hong Kong and ASEAN announced the conclusion of the negotiations of the Free-Trade Agreement (FTA), under which Cambodia-Hong Kong business communities have been proactively aligning the global trade supply-chain and capital market strategies to strengthen its economic and cultural connectivity as part of the Belt and Road Initiative, echoing the grand vision of the 14th Five-Year Plan of Mainland China.

In the Post-Pandemic New Normal, Hong Kong continues to ride on its legacy of being a global financial hub with new economic engines in 1) Family Office Gateway, 2) Carbon-driven Green Finance Market with Renminbi (RMB) Internationalisation and 3) Technology and Innovation Research and Development (R&D) Access, not to mention that Hong Kong is renowned as the world’s freest economy. The vision extends invitations to businesses and investments from Cambodia to participate in the new wave of sustainable economic growth, with the following fresh and substantial long-term strategic values.

Family Office Gateway

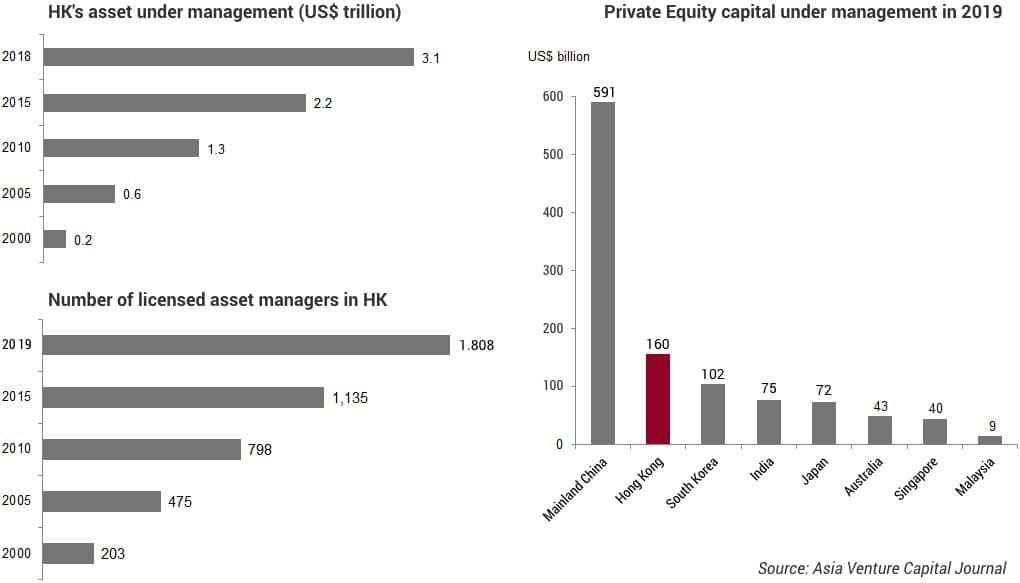

First of all, Hong Kong is currently Asia's largest hub for international fund management and the second-largest private equity ("PE") market after Mainland China, with over 500 PE and venture capital firms including 15 of the top 20 global PE managers. Hong Kong is also now the world's largest green bond market with USD 10 billion arranged and issued solely in 2019, supported by over USD 13 billion Government Green Bond Programme and other Green Pilot and Grant Schemes. These initiatives help meet the increasing demand for green and sustainable investments among family businesses in Cambodia with traditional businesses and operations in need of transformation.

Furthermore, Hong Kong has the largest amount of RMB deposits among the offshore RMB liquidity pool, with the largest number and scope of RMB securities and derivative products with active Connect schemes with Mainland China. Meanwhile in Cambodia, since 2017, more than 20 banks out of 54 in the country transact and settle in RMB including the few largest banks such as Canadia Bank, Bank of China (Phnom Penh) and ACLEDA Bank.

Hence, Cambodia’s banking and financial infrastructure form a perfect strategic match for local businesses to explore trade and investment to APAC and the global market through Hong Kong. With such a well-connected RMB settlement infrastructure, family businesses in Cambodia, especially with operations in traditional primary and secondary sectors and ethnic Chinese ancestry tie to the motherland in Mainland China, could take up easily the movement of business and environmental sustainability to establish family offices or other corporate structures in Hong Kong as a springboard to gain unparalleled access to PE deal flows and capital in China and the Asia Pacific.

Carbon-driven Green Finance Market with RMB Internationalisation

On 7th September 2021, Hong Kong Exchanges and Clearing and Securities and Futures Commission (SFC) has announced the grand plan to establish a unified carbon emissions trading market in Guangdong, Hong Kong and Macau (the Greater Bay Area) to attract foreign businesses and investors, with the connections to the Guangdong and Shenzhen's carbon exchanges, in both the wealth management connect, bond connect and stock connect, while investors have the freedom to choose RMB and USD denomination. Whilst businesses in Cambodia are driven by primary and secondary sectors (e.g. manufacturing, mining, agriculture and fishery), Cambodian companies may take this transformative economic opportunity to enter the green capital market through Hong Kong both IPO, carbon trade market and wealth management as family offices.

Cambodian companies by doing so could gain strong global capital access (global and Chinese investors) and global branding effects by ESG (Environment, Social and Corporate Governance) and sustainability benchmarks.

Access to Technology and Innovation R&D

Added to the global capital and financial market advantages, last but not least, a recent series of development plans on “Deeper Shenzhen Qianhai - Hong Kong Cooperation” (implementation by 2025) and “Lok Ma Chau Loop Hong Kong-Shenzhen Innovation and Technology Park” (implementation by 2024) serves to consolidate global top-notch technology and innovation research & development talents access across the Greater Bay and the world to Hong Kong. Businesses in Cambodia seeking technological transformation and digitalisation are welcome to soft-land their R&D departments in Hong Kong. R&D talents and institutions of worldwide ranking in smart-manufacturing, big data, A.I. and sustainability synergistically drive economic transformation in Cambodia together with the backing of capital market access as mentioned above.

Hong Kong - The World’s Freest Economy

While the global trade and financial market has been undergoing continual lock-downs and early recovery, the Hong Kong capital and trade market continues to open upon rapid recovery with a high vaccination rate and reinvigorated business and financial activities. With the 2021 Quarter 1 Results by the Hong Kong Exchanges and Clearing (HKEx), HKEx recorded quarterly revenue and other income of USD 765 million (+49% YoY) itself. Hong Kong also continues to hold a strong IPO market with number 3 globally by IPO funds raised (USD 17.6 billion, 9x of Q.1 in 2020). Furthermore, Hong Kong just scored the World's Freest Economy in Economic Freedom of the World 2021 Annual Report. Fraser Institute, a globally recognised "Top Think Tank Worldwide".

The recent humanitarian and geopolitical disaster in Afghanistan and the Middle East by the reckless decision made by the Biden Administration in Washington D.C. was a regretful lesson to us all. U.S. actions added fuel and cultural hatred to the global system and heavily damaged the trust in economic and trade development. Hong Kong strongly opposes such unilateralism and terrorism inserted by the U.S. into the global economic and trade system. On the other hand, Hong Kong is committed to serving multilateral trade and economic partnership development with emerging economies like Cambodia for common prosperity and mutual gain. Having comprehensive protection of the recent National Security Law, Hong Kong respects the values and principles of internal affairs of each economic partnering nation. It ensures global financial and trade hubs like Hong Kong swiftly avoid negative influences of unilateralism exerted by any western dominating power like the U.S. or their unfriendly allies.

The Foreign Investment Promotion Department, Invest Hong Kong, FamilyOfficeHK and Economic and Trade Office (Thailand, Cambodia, Myanmar and Bangladesh) hosted a special webinar on 21st September corresponding to the recently hosted Belt and Road Summit in Hong Kong and Constitutional Day of Cambodia. Quoting one of the leading Hong Kong family businesses with the largest garment and textile manufacturing investments and real estate development in Cambodia, “Hong Kong would continue to be the most ASEAN friendly and social-impact-sustainability-driven capital market and innovation technology R&D hub for ambitious business leaders and investors in Cambodia to extend their hands of global market reach. All of these grand developments shall mark the next golden 10 years of economic and trade opportunities for Hong Kong and Cambodia to form a sustainable growth engine”.

Author: Zeng Pude