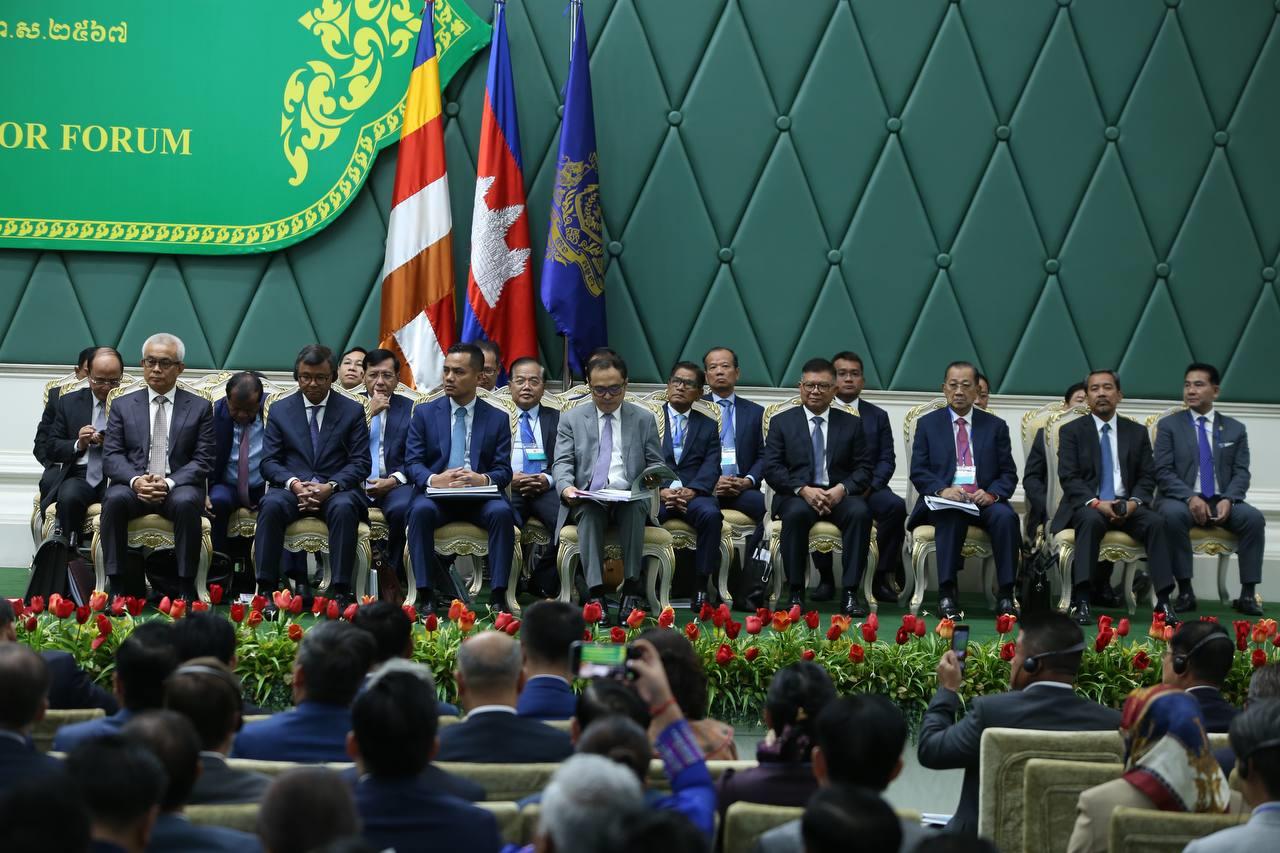

Phnom Penh (FN), Nov. 13 – The Royal Government will neither introduce new taxation laws nor raise existing tax rates, Cambodian Prime Minister Hun Manet spoke at the 19th Government-Private Sector Forum (G-PSF), held on Monday (Nov. 13) at the Peace Palace.

On that occasion, Samdech Thipadei underscored the pivotal role of tax collection in bolstering national socio-economic development.

Highlighting the past decade's substantial economic growth, the premier noted the significant rise in tax revenue in Cambodia. This increase has empowered the Royal Government to construct vital infrastructure, including roads, bridges, school buildings, and hospitals across the nation.

Furthermore, the generated tax revenue has enabled the Royal Government to establish reserves dedicated to combating COVID19. These funds have been instrumental in providing free COVID19 vaccines to citizens nationwide and extending various forms of support to households. This assistance aims to sustain stable livelihoods and mitigate the adverse effects of the outbreak.

Lastly, Premier Hun Manet added that the Royal Government decided to continue to eliminate taxes such as slaughter tax, contract tax, stamp duty, inventory tax on administrative letters, court letters, and tax rate documents for transportation of motorcycles, tricycles and tractors and stamp duty on company registration letters.

Premier Hun Manet emphasized that the Royal Government will continue to exempt taxes on family-owned agricultural land, agricultural equipment, agricultural products, and real estate valued at less than 100 million Riels or USD 25,000. This tax exemption extends to stamp duty on real estate transfers within family relationships, including parents to children, grandparents to grandchildren, spouses, and husbands for gifts and inheritance. Additionally, the exemption encompasses value-added tax on primary food consumption until the end of 2028, along with taxes on the minimum wage of civil servants and workers at all levels. These tax policies will continue to be enforced under the current government mandate.

=FRESH NEWS