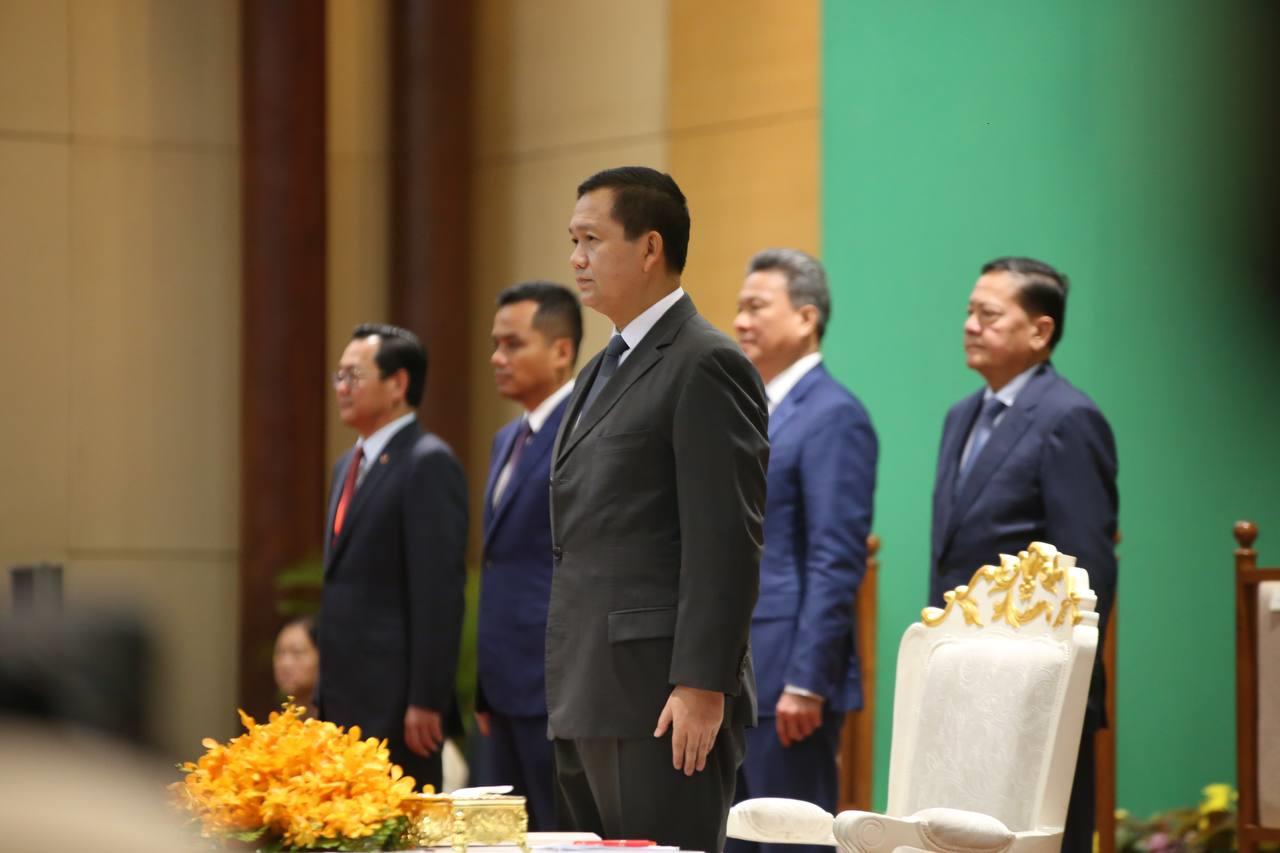

Sihanoukville (FN), Jan. 31 – Cambodian Prime Minister Hun Manet announced to launch the “Special Program to Promote Investment in Preah Sihanouk Province 2024”, speaking on Wednesday morning (Jan. 31) during the official launch of the investment program.

This special program applies to investment projects or business activities in 2024, located in Sihanoukvile Province, and focuses on the following three types of projects: (1) Investment projects or business activities related to unfinished buildings and will start implementation in 2024; (2) Investment projects or business activities that are not related to the unfinished buildings, but will immediately start operation in 2024; (3) Expansion of existing investment projects or business activities in accordance with the specific criteria and will begin in 2024.

To address the issue of stagnant investment projects in Sihanoukville, Samdech Thipadei Hun Manet announced the provision of "special benefits" that the Royal Government has decided to implement within the framework of "special programs" for stagnant investment projects to receive the benefits as follows:

Firstly, for investment project related to unfinished buildings:

- Exemption of income tax, prepayment of income tax and minimum tax for an additional 3 years for Qualified Investment Projects (QIP) and tax-registered small and medium enterprises;

- Exemption of Value Added Tax at the rate of zero percent for self-assessed enterprises that supply local goods or services to stagnant projects or business activities in Preah Sihanouk Province to finish the construction and renovate the unfinished buildings;

- Exemption of withholding tax on rental property for 5 years;

- Waiving for payment of public service fees and excessive fees of the land use index for applying for a construction permit, construction site opening permit, closing construction letter, or certificate of occupancy;

- Facilitate the procedures and formalities for applying for a permit from the competent authority related to construction work, including reducing the time for applying for a construction permit or certificate of occupancy;

- Facilitate the grant of exemption of the inspection and certification fees of architectural plans, construction machinery layout and fees for construction quality and safety inspection and certification in collaboration with ministries, institutions, private sector, landowners and construction owners;

- Prepare principles and facilitate the establishment of a real estate auction sale market and provide services for matching investors, including setting out the reference price for real estate in Preah Sihanouk province;

- Promote the use of Out-of-Court dispute resolution mechanisms in accordance with legal provisions for investment-related disputes.

Secondly, for investment projects non-related to unfinished buildings:

- Facilitate investment and business formalities and procedures, including applying for licenses, certificates, and permits, as well as QIP and business registration;

- Provide special incentives and exemptions, such as import taxes, patent tax, signboard tax, withholding tax on rental property, and registration fees so on and so forth, to enterprises that come to invest or do business in Preah Sihanouk Province;

- Provide incentives by exempting income tax, prepayment of income tax, and minimum tax for an additional 3 years for the QIP and tax-registered small and medium Enterprises;

- Allow zero percent of VAT for small and medium enterprises registered for tax for the purchase of domestically produced inputs;

Thirdly, for expansion of existing projects:

- Facilitate investment and business formalities and procedures, including applying for licenses, certificates, and permits, as well as QIP and business registration;

- Provide special incentives and exemptions, such as import taxes, patent tax, signboard tax, withholding tax on rental property, and registration fees so on and so forth, to enterprises that come to invest or do business in Preah Sihanouk Province;

- QIP, which proposes to expand and implement its investment activities, shall receive incentive on income tax exemption for a certain time, depending on the type of investment activity of the original project, based on the proportion of capital expansion in accordance with Sub-Decree on the Implementation of the Law on Investment of the Kingdom of Cambodia and authorized to take 150% multiplied by the income to be tax-exempt incentive as a basis for calculating income tax;

- Small and Medium Enterprises that have received incentives under the Sub-Decree on Tax Incentives in Priority Sector and requested for expansion and implementation of their business activities shall receive additional incentives for 3 years of exemption on income tax based on the proportion of expansion capital rate and allow to take 150% multiplied by the income to be tax-exempt incentive as a basis for calculating income tax.

On the occasion, Samdech Thipadei added that in addition to providing "special benefits" to the above three projects or activities, the Royal Government has also introduced a number of necessary measures to support and encourage additional investment and Industrial development in Sihanoukville. Those measures include:

- Establish investment projects and/or development land use sites step by step in villages, communes/Sangkats, and main roads, such as Great Tourism Zones, Duty- Free Shop Zones where all nationalities can buy, Food Streets, and Resorts/Entertainment Places in accordance with potential and actual geography;

- Provide a special 3-year visa for the long-term purchase or rental of property in Preah Sihanouk Province that costs over USD 100,000. This type of special visa shall be determined by a separate Sub-decree;

- Expedite customs inspections, adjust and provide good services to tourists and investors at the time of arrival, stay, and return;

- Organize “Safe City” campaign, events and programs to restore and strengthen Preah Sihanouk Province’s reputation on the international stage;

- Expedite the approval and promulgation of the master plan to transform Preah Sihanouk Province into a multi-purpose model special economic zone;

- Prioritize and invest in infrastructure projects necessary to support industrial development, tourism development, and investment attraction;

- Develop large industrial zones and parks, especially strengthen existing Special Economic Zones to reach international standards in all aspects, including infrastructure development, electricity supply, clean water, raw materials, and other inputs, transportation and trade facilitation, other incentives and supportive measures;

- Facilitate the development of potential land (State or Private land ownership) to turn these lands into industrial or enterprise cluster zones and/or tourism areas where the Royal Government will be involved in supporting exemption policies, incentives, and infrastructures;

- Implement one or more pilot test areas, such as Special Economic Zones, Great Tourism Zones, Free Trade Zones, Industrial Cluster Zones, or Customs Bonded Warehouse to mobilize resources and promote rapid and efficient development that can be selected from areas to be expanded, or in Stueng Hav or other places through cooperation between the state and the private sectors, the construction of common infrastructure and other activities altogether.

=FRESH NEWS