Phnom Penh (FN), Dec. 16 – Cambodian Prime Minister Hun Manet stated that all informal economy workers with an annual income below 250 million riels (approximately USD 60,000) are exempt from taxes, do not need to pay patent tax, and are not required to prepare tax declaration documents.

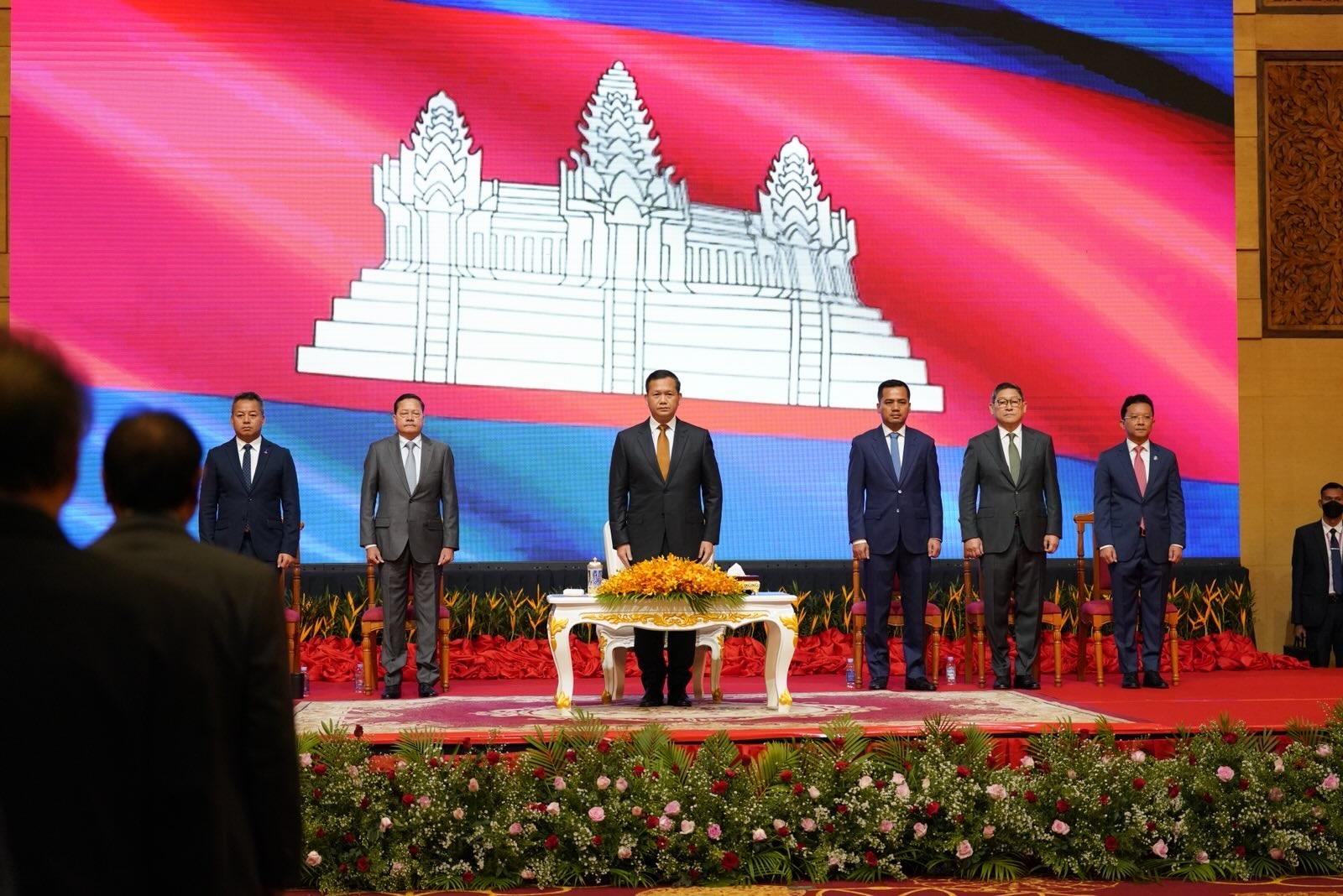

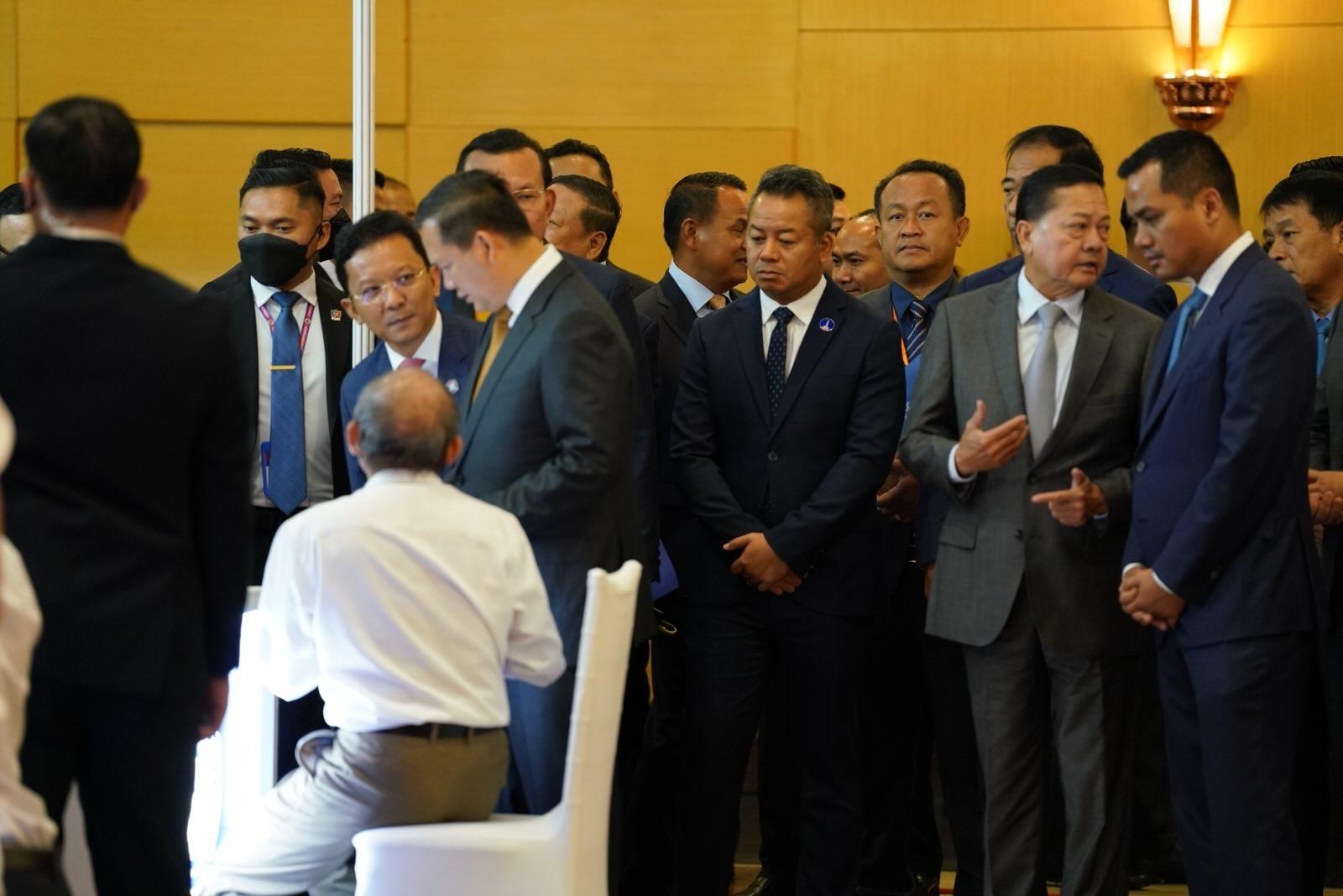

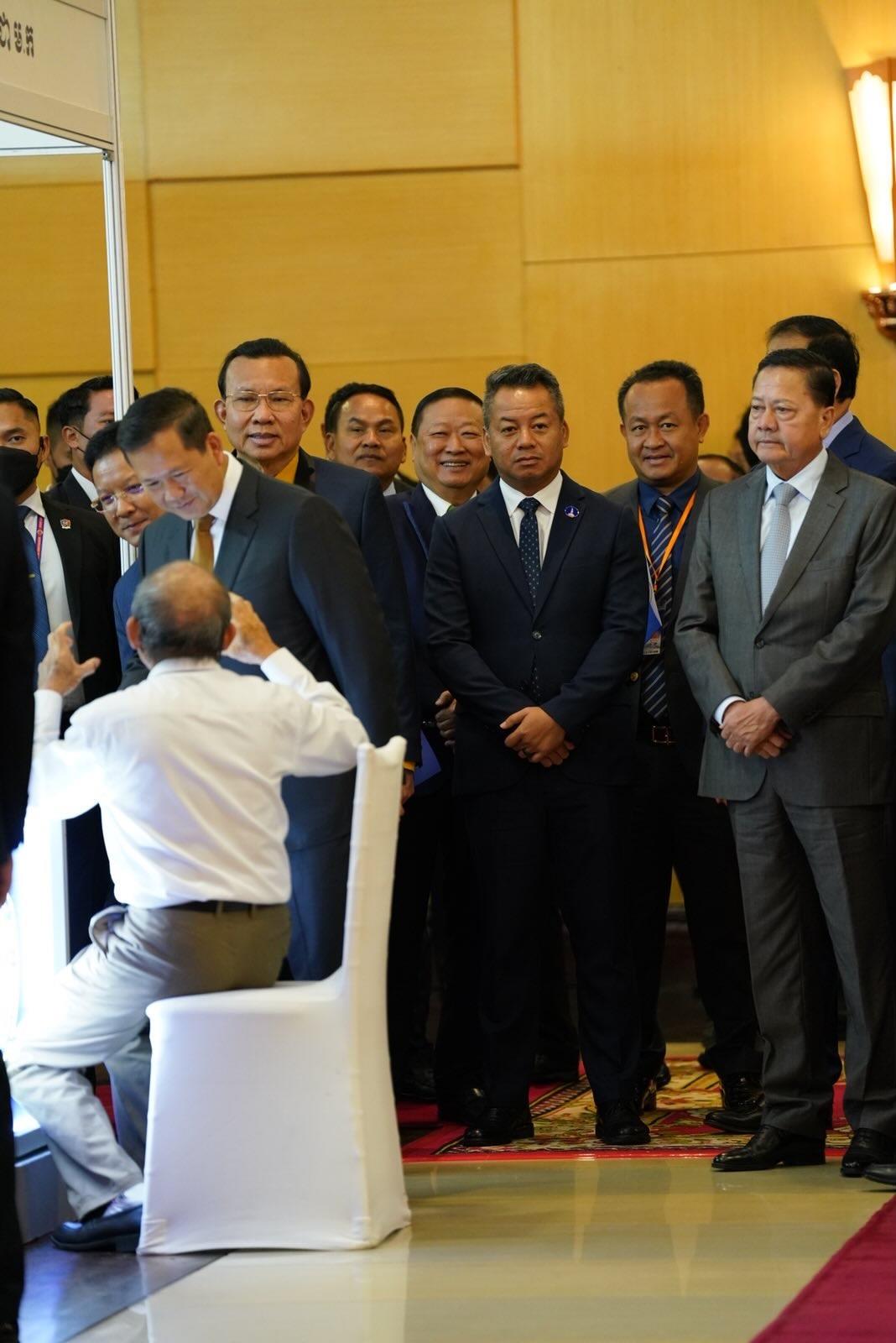

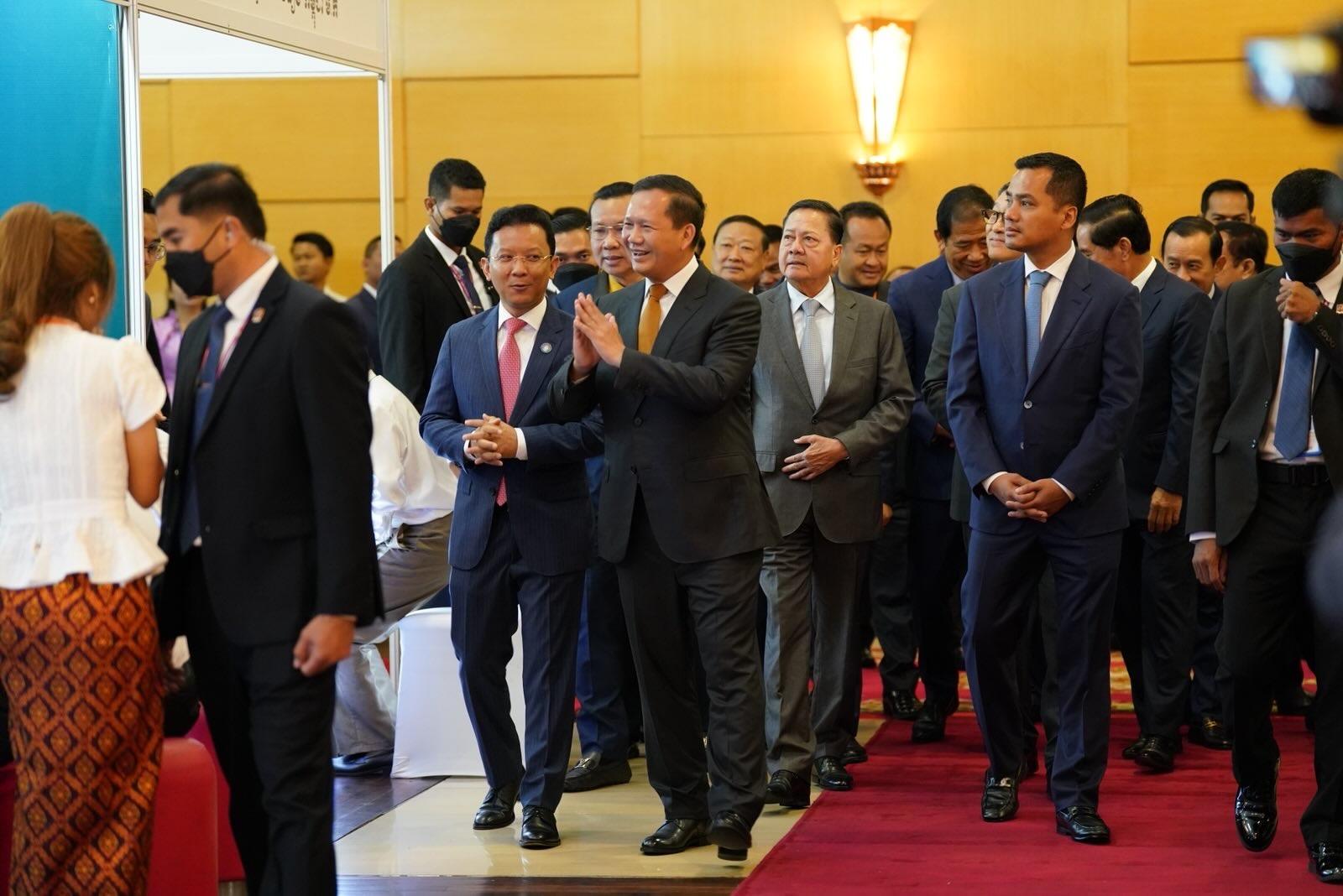

The premier spoke on Monday (Dec. 16) at the launching of the digital platform for informal economy registration, held at Sokha Phnom Penh Hotel.

Samdech Thipadei underscored, “I would like to confirm that informal economy workers with an annual turnover of less than 250 million riels, including small and micro-sized enterprises, are not required to pay taxes, do not need to pay patent tax, and are not obligated to prepare any tax declaration documents. This is a firmly established principle.”

The tax exemption for informal economy workers earning less than 250 million riels annually reflects the Royal Government’s commitment to supporting the welfare of informal workers, ensuring they are not burdened with unnecessary costs. He noted that this principle was first announced during the Royal Government's one-year anniversary.

Samdech Thipadei added that the registration of informal economy workers is entirely voluntary, without coercion, and free of charge. This registration not only provides official recognition but also opens the door to additional opportunities for growth and support.

Prime Minister Hun Manet explained that after registering and receiving approval through the digital platform, informal economy workers will be issued a Certificate of Registration for Informal Economy Workers. This certificate acknowledges their role and contribution to the national economy. It certifies the worker’s professional, business, and occupational identity and is officially recognised by all ministries and institutions of the Royal Government, at both national and sub-national levels. Additionally, it can be used in official dealings with the private sector.

=FRESH NEWS